debt and equity financing how to decide

But too much debt is also risky and thus companies. This is a great advantage for startups with no credit past.

Debt Versus Equity Financing Why The Difference Matters

That means this process is the opposite of equity financing.

. Equity financing is costly compared to debt financing since tax savings can be made on debt while equity is tax payable. The choice that is right for you will be very specific to your business. The factor company then chases up the debtors.

Determining your financing needs Equity vs. When looking at the advantages and disadvantages of debt financing it is essential to remember that these funds must get paid back. When you need less than 50000.

This is a quick way to get cash but can be expensive compared to traditional financing options. It is a viable option when interest costs are low and the returns are better. In this article we will briefly discuss seven factors to consider when choosing between debt and equity financing options.

Debt financing Loans Grants Venture capital Angel investors Savings retirement and other investment accounts Crowd funding Peer-to-peer lending Family and friends and SBA Surety Bond Guarantee Program Numerous additional resources are identified to assist you. Broadly speaking funding your small business falls into two categories. Shareholder equity equals a companys assets minus its debt so ROE measures a companys profitability as it relates to the shareholder equity.

Having high leverage in a firms capital structure can be risky but it also provides benefits. The debt-to-equity ratio also known as the DE ratio is the measurement between a companys total debt and total equity. Read more of that industry the business needs to decide how much new shares they will issue for equity financing and how much secured or unsecured loan they would borrow from the bank.

It not only means the ability to fund a. Equity financing has its own advantages and disadvantages as compared to other types of financing specifically debt financing. In other words youll need to have paid off at least 20 of the current appraised.

Financing through debt comes in the form of a business loan. Examples include oil gas automobiles real estate metals mining. For forms related to.

By understanding how consolidating your debt benefits you you will be in a better position to decide if it is the right option for you. A reporting entity should elect one of. Youll usually need to have at least 20 equity in your home to qualify for a cash-out refinance.

Companies do however need a great business plan to convince potential investors. Striking a balance between debt and equity is not always possible. Unlike debt equity financing doesnt require repayment.

Firms will decide the appropriate mix of debt and equity financing by optimizing the WACC of each type of capital while taking into account the risk of. For additional information on start-up financing see Pre-IPO Liquidity for Late Stage Start-Ups and Venture Financing Overview. As the owner of your new business it will be critical for you to think about what you.

Here are pros and cons for each and how to decide which is best for you. Before you decide on this option think carefully about how this arrangement could affect your. Disadvantages of Debt Financing Investor preference for low geared companies.

Debt or equity financing. But the business should make sure that they can take. As with equity there are a handful of scenarios where debt is the most useful option for financing your company.

By extending the loan term you may pay more in interest over the life of the loan. Investors hope to see a return on their money by receiving dividends or an increase in the share price of their investment. Debt raises lend themselves well to smaller amounts of capital.

ROE utilizes both the income statement and the balance sheet in which profits are compared to shareholders equity. Essentially you will have to decide whether you want to pay back a loan or give shareholders stock in your company. The payment reduction may come from a lower interest rate a longer loan term or a combination of both.

O Simple agreements for future equity SAFE o Preferred stock Securities law considerations This practice note assumes that the company is a Delaware C corporation which is the market standard for venture backed companies. The Pros The Cons. The following table discusses the advantages and disadvantages of debt financing as compared to equity financing.

Both debt and equity financing have pros and cons for all new business owners. Loans may be secured by assets which means a lender can take assets if the loan isnt paid back or unsecured which means there is no specific collateral pledged for the loan. Company Ownership - Debt financing is pretty straightforward legally.

A company undergoes debt financing because they dont have to put their own capital. Advantages of Debt Compared to Equity. The bank or investor does not own any portion of your business and they dont have any say in your day-to-day operations.

Debt financing means youre borrowing money from an outside source and promising to pay it back with interest by a set. It might be tempting for startups to pursue angel investors or venture capitalists. The Pros and Cons of Equity Financing Debt Financing.

When comparing debt to equity the ratio for this firm is 082 meaning equity makes up a majority of the firms assets. As long as you are making your payments on time they will pretty much stay out of your way. For instance if a company has a debt-to-equity ratio of 15 then it has 15 of debt for every 1 of equity.

Many companies have been declared bankrupt due to the massive amounts of debt they have taken including some of the worlds most popular companies such. List of the Advantages of Debt Financing. The Pros of Equity Financing Equity fundraising has the potential to bring in far more cash than debt alone.

Debt and equity financing are very different ways to finance your new business. Visit the Resource icon in the course player. Leverage ratios represent the extent to which a business is utilizing borrowed money.

Interest The most. Therefore we believe a reporting entity may elect to amortize debt issuance costs discounts and premiums related to callable debt over either the contractual life of the debt instrument consistent with term debt or the estimated life of the debt instrument by analogy to the guidance for increasing rate debt in ASC 470-10-35-2. To obtain equity financing a company does not need to have a good credit rating.

If you are a business owner who needs an influx of capital you typically have two choices. And with those smaller goals theres less riskfor. In other words the debt-to-equity ratio tells you how much debt a company uses to finance its operations.

If you need outside funding to grow your business ask yourself four questions before choosing between debt and equity financing. It also evaluates company solvency and capital structure. Because the lender does not have a claim to equity in the business debt does not.

Understanding debt vs equity financing pros and cons can help you decide which way to go. Debt financing allows you to keep control. Debt financing is an expensive way of raising funds because the company has to involve an investment banker who will structure big loans in a systematic way.

Importance and usage. Pros and Cons of Debt Financing. At such small amounts giving up equity doesnt make much sense anyway.

Debt financing occurs when a firm sells fixed income products such as. Debt financing is the opposite of equity financing which entails issuing stock to raise money. If a friend or relative offers you a loan its called a debt finance arrangement.

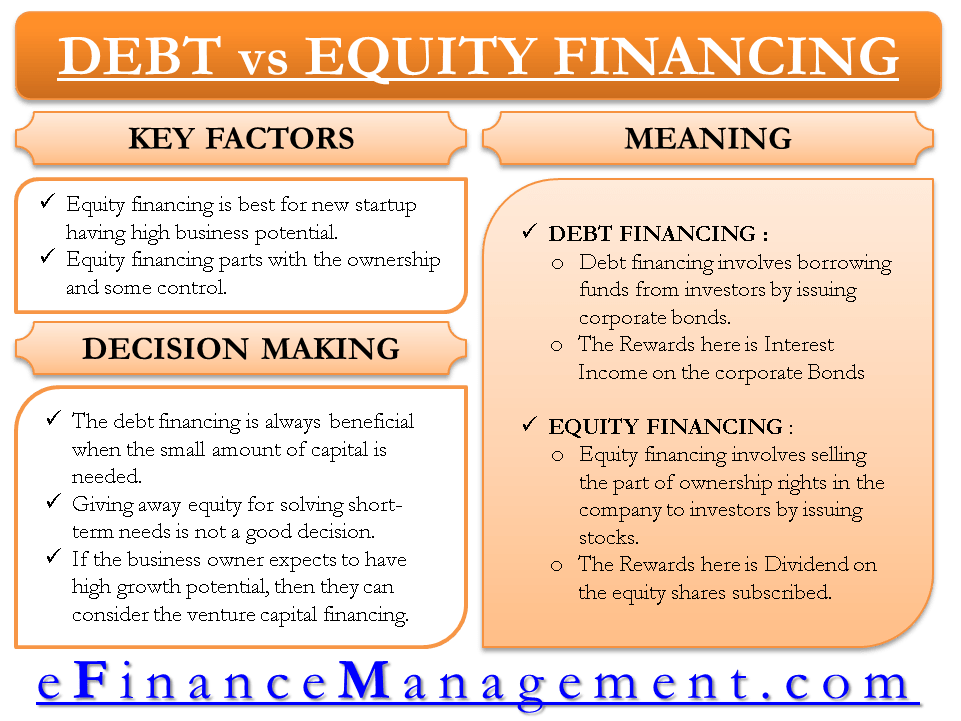

Debt Vs Equity Financing Efinancemanagement

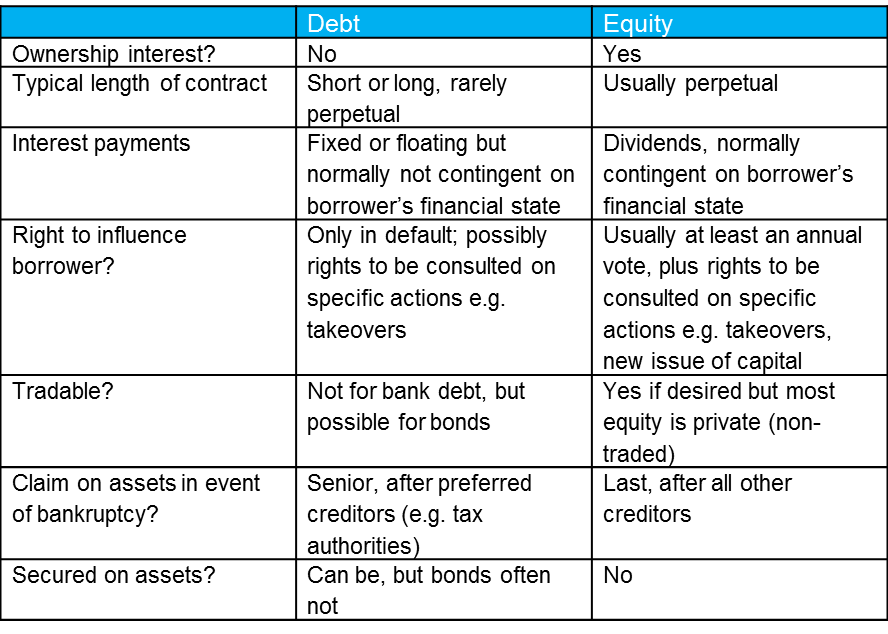

Classifying Funds The Type Of Contract Is It Equity Or Debt Simon Taylor S Blog

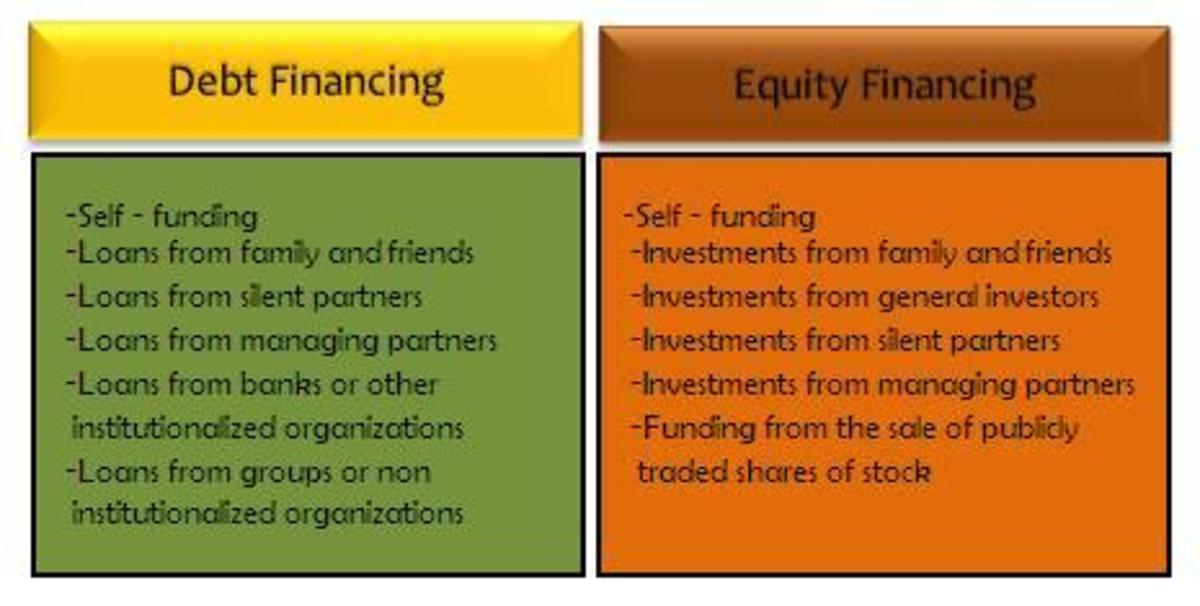

Differences Between Debt And Equity Ppt Download

Equity Vs Debt Financing Fundsnet

7 Factors To Consider When Choosing Between Debt And Equity Financing

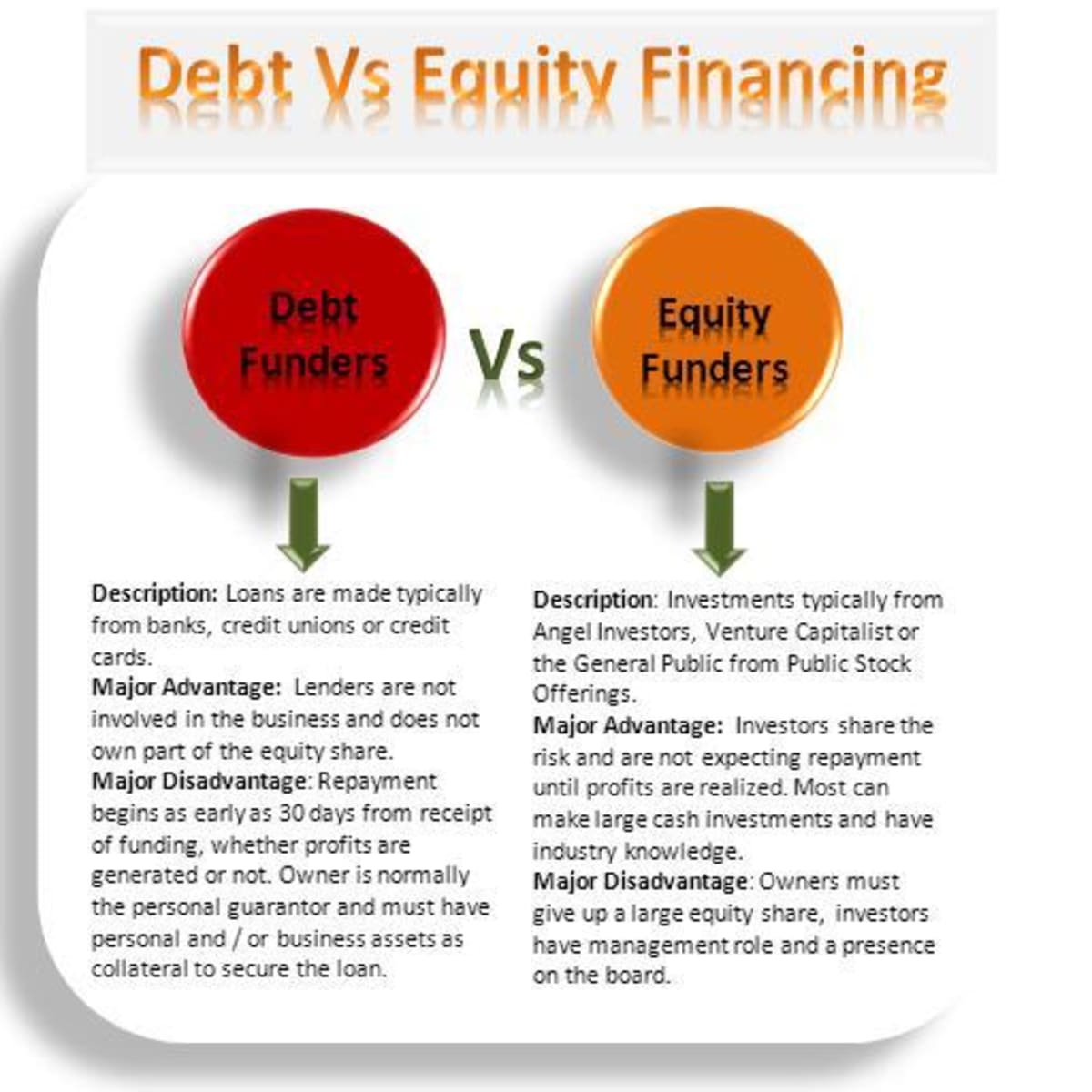

Debt Vs Equity Financing Which Is Best For Your Business Venture And Important Tips Before Approaching Funders Hubpages

Debt Vs Equity Financing Which Is Best For Your Business Venture And Important Tips Before Approaching Funders Hubpages

Equity Financing Examples The Best Guide In 2022

Debt Vs Equity Financing Which Is Best For Your Business Venture And Important Tips Before Approaching Funders Hubpages

0 Response to "debt and equity financing how to decide"

Post a Comment